Non-Fungible Tokens, or NFTs, are unique cryptographic tokens that represent digital or physical assets. The NFT frenzy has skyrocketed NFT sales in the last few years; these digital assets can be found on the best NFT marketplaces such as OpenSea.

With NFTs taking various forms: from being used to represent ownership of luxury handbags in Ethereum’s CryptoKitties game to sports collectibles, the top Non-fungible tokens have made the transition into the NFT space seamless for artists, collectors, and investors.

As the NFT world continues to grow and develop, NFT tokens are making as big a splash as NFTs themselves playing a key role in the NFT ecosystem. With more and more NFT-based games emerging, it is clear that NFT coins are only going to continue their upward trend in the coming year. For investors looking to get in on this burgeoning market, the question then becomes what is the best NFT crypto to buy now.

Table of Contents

What are NFT Tokens?

NFT coins are tokens used within the blockchain to support their economies. These coins are what players can use to transfer, buy and sell in-game items, and they give players the ability to earn profits by selling their characters and gear.

As the NFT craze expands and more and more investors are turning their attention to collectible elements like tokens. With the volatile nature of the crypto market, it’s not surprising to see prices for these assets fluctuate wildly, going from a few dollars to thousands in a matter of days or weeks.

What is the Difference Between NFTs and Crypto Tokens?

NFTs and NFT tokens offer investors the potential for appreciation, but they are very different. NFTs are non-fungible tokens that cannot be replaced or exchanged for another token of the same type. NFT tokens, on the other hand, can be exchanged for other tokens of the same type. For this reason, popular NFTs may be more appealing to investors who are looking for a long-term investment, while NFT tokens may be more appealing to those who are looking for a shorter-term investment.

Below are the main differences between an NFT Project and NFT Coins:

NFTs:

NFTs are used to verify ownership on the blockchain. Unlike other tokens, NFTs are not mutually interchangeable and each one is unique. Although NFTs are widely seen as a high-risk investment, they offer a way to verify ownership of digital assets in decentralized finance.

NFTs are often used in tokenizing real-world assets or events. A typical example of this is the NFT marketplace NBA Top Shot that tokenizes in-game moments and sells them as NFTs. NFTs have more robust use cases than crypto tokens and can be used for a wide variety of applications. For example, NFTs can be used to represent ownership of digital or physical assets or to represent tickets or other forms of access. They are helpful in the digital art, music, video, and gaming industries.

Cryptocurrency:

Cryptocurrency coins are fungible, meaning one crypto can be exchanged for another. They are mainly used as payment for transactions. They are decentralized, meaning there is no central authority. Cryptocurrencies allow for fast and secure NFT transactions without the need for a third party.

Cryptocurrencies are primarily used for settling payments and powering operations on a particular blockchain. NFTs, on the other hand, serve as verifiable proof of ownership on the blockchain and can’t be divided or exchanged like crypto-assets.

The most important distinction is their fungibility. Cryptocurrencies can easily be traded for one another on multiple cryptocurrency exchanges. However, this is not the case for NFTs, which are unique and indivisible. This means that a rare NFT cannot be exchanged for another NFT.

Important NFT Token Terms

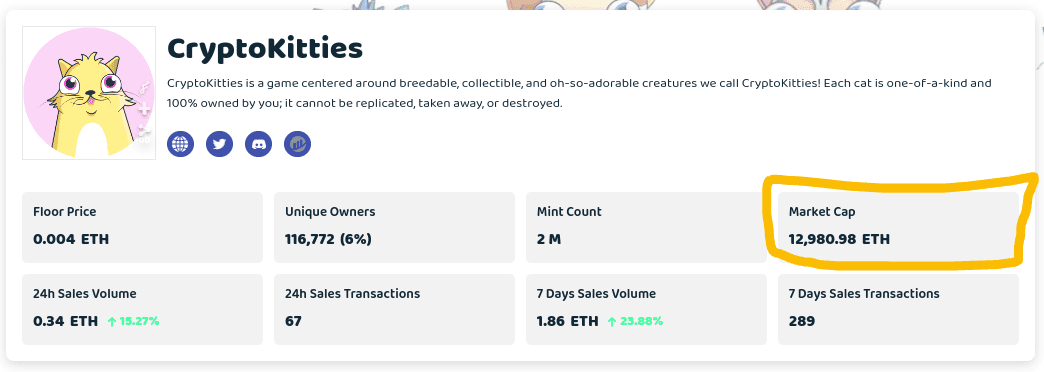

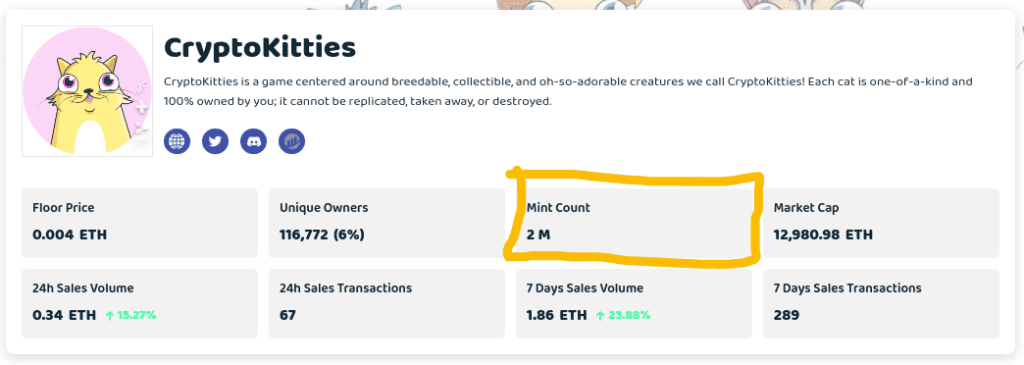

Market Capitalization – Market capitalization (or market cap) is the total value of all the coins that have been mined. It’s calculated by multiplying the number of coins in circulation by the current market price of a single coin.

Circulating Supply – The total number of coins or tokens that are actively available for trade and are being used in the market and by the general public.

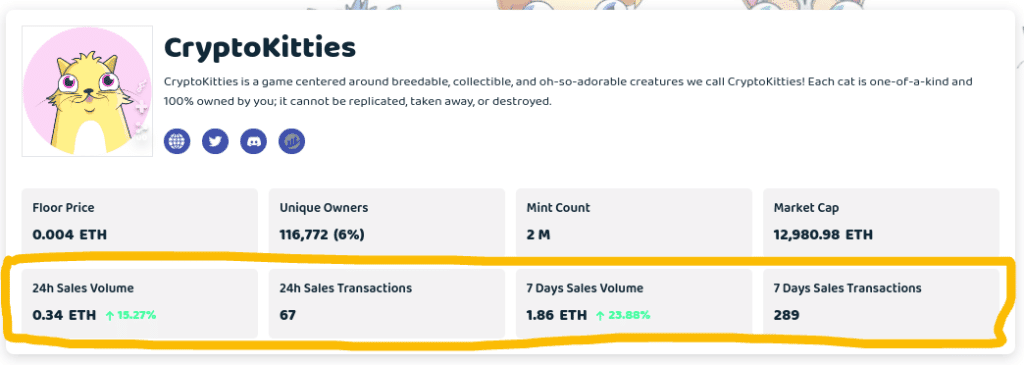

Volume – The “trading volume” is a measure of the total amount of non-fungible token sales currently taking place across the blockchains.

Top NFT Tokens by Market Cap

ApeCoin

Yuga Labs is a community member of the ApeCoin DAO and the creator of the Bored Ape Yacht Club. They have adopted ApeCoin as their primary token in the NFT collections they undertake. Their work focuses on creating new and innovative ways to use blockchain technology.

ApeCoin is the currency of the APE ecosystem, used to reward users for sharing their data and charging subscribers a small fee for its use. It’s governed by a decentralized autonomous organization (DAO), meaning that token holders can have a direct say in how the system should grow. They can also vote on the direction of future development once we’ve built the necessary infrastructure.

The BAYC

Bored Ape Yacht Club (BAYC), one of the most popular NFTs, launched in April 2021. The platform features 10,000 unique Apes residing on the Ethereum blockchain. Each of these digital collectibles has a different look, style, and rarity. The BAYC platform offers users the chance to buy, sell or trade these virtual apes.

Mutant Ape Yacht Club (MAYC)

MAYC represents the latest innovations from Yuga Labs. Bored Ape Yacht Club holders are rewarded with this brand-new NFT collection called a “freak,” for being early investors.

Although Bored Apes are primary among celebrities and investors, the Mutant Apes offer more affordable access to the BAYC community.

How ApeCoin Works

ApeCoin holders can collectively make decisions on important matters like how to allocate funds, what rules to follow, partnerships, and which projects to pursue. The ApeCoin Foundation implements the decisions that the community makes. This allows for a decentralized form of governance that is transparent and fair.

The ApeCoin Foundation is the legal body that represents the DAO and helps it to grow. The Board is a special group within the Foundation that makes decisions on behalf of the community. It is made up of five members who are experts in technology and cryptocurrencies. Every year, the people who hold ApeCoins get to vote for who will be on the Board.

What is ApeCoin Used For?

ApeCoin is a digital asset that provides holders with voting rights and access to exclusive features and services within the ApeCoin ecosystem. By holding ApeCoin, users can participate in the governance of the DAO and have a say in how the community is run. In addition, ApeCoin holders can enjoy perks such as discounts on games, events, and merchandise.

ApeCoin is a digital currency that can be used for payments, just like any other Web3 coin. ApeCoin is based on the ERC-20 token standard and is therefore accepted by most merchants. The coin is also used as an NFT reward, and holders of the BAYC token receive free APE that they can redeem immediately.

ApeCoin provides an ecosystem for developers to create services, games, and other projects. The coin incentivizes players in Animoca Brands’ Benji Bananas mobile game by allowing them to earn special tokens that can be swapped for ApeCoin. This allows players to be rewarded for their gameplay and encourages them to keep playing.

With ApeCoin set to be integrated with the upcoming metaverse Otherside, there is potential for the coin to be in high demand this year. This is because ApeCoin would act as a transaction token on metaverse marketplaces if Metaverse incorporates P2E elements. Players could be rewarded with ApeCoin for their accomplishments.

FLOW

Flow is a user-friendly platform that is also powerful enough to handle large-scale projects. The entire platform was designed with the user experience in mind. Flow was created by the team behind the popular NFT collection CryptoKitties, but today it is supported by a growing community of brands and Web3 builders.

The native token FLOW was created to help users conduct their first transactions and provide a minimum balance for them to use. In the future, there will be epochs where new nodes can join or leave the protocol. Consensus nodes will also be able to arbitrate challenges and improve the performance of the NFT protocols. Finally, the programming language used will be upgraded to Cadence.

The Flow blockchain is designed to provide scalable solutions for apps, games, and other digital assets. It is fast, decentralized, and developer-focused and its unique design allow it to scale without sharding.

Flow’s initial supply of 1.25 billion tokens was just the beginning. An additional 250 million FLOW tokens were allocated for staking and delegation purposes, as well as collateral subsidies to secondary protocols. These tokens are not circulating due to the anticipated lockout, meaning they are not available for general use.

How Flow Works

Flow introduces a new way of processing transactions in blockchains, called pipelining (allowing data to flow from a specific source). This involves categorizing validator node operations into four distinct categories: collection, consensus, execution, and verification. By doing this, there is a much more efficient division of work between nodes, as each one can specialize in a certain stage of validation. As a result, the overall process is faster and more reliable.

Flow provides an opportunity for much higher throughput at a lower cost while retaining a shared execution space for all network operations. This guarantees a better user experience and complete composability, letting developers easily build on the work of others.

As of today, you can use Flow to trade digital collectibles on the NBA Top Shot marketplace or to buy and sell other items on VIV3 NFT marketplace and other blockchain apps. If you’re a developer, you can start experimenting with Flow to build your own DApps, using the many built-in tools.

Flow’s focus on modularity enables developers to create innovative user experiences that take advantage of the network’s capabilities. For example, by building on top of existing resources like a user base, data, security, and code, developers can compose sophisticated multi-layered DApps. In addition, the platform provides ACID (atomic, consistent, isolated, and durable) technology and upgradeable smart contracts. This makes it possible for developers to test and improve smart contracts.

What is FLOW Used For?

With Flow, developers can easily integrate peer-to-peer payments, charging for services, or consumer rewards directly into their apps. FLOW is also very easy to hold, transfer, or transact peer-to-peer, making it the perfect currency for everyday use.

As a FLOW token holder, you can earn rewards by staking your tokens as a security deposit and helping to secure the network through running validator nodes, or by delegating your stake to other validator nodes. Every activity on the network requires a small number of FLOW tokens for gas, whether it’s creating new user accounts, storing digital assets, or smart contracts. So by participating in activities on the network, you’re also helping to support its development.

Mana Cryptocurrency

Decentraland is a virtual reality (VR) platform fueled by the Ethereum network. Users can create, experience, and monetize a variety of content and applications. The native digital token for this world is MANA cryptocurrency, an ERC20 token used to pay for virtual plots of land, goods, and services. As a fungible token, MANA can be swapped with other ERC20 tokens.

Decentraland consists of three key layers – consensus, land content, and real-time visualization – that work together to provide users with a one-of-a-kind gaming and virtual reality experience.

The Decentraland platform enables users to engage with the world through the use of two NFT tokens, LAND and MANA. LAND tokens represent a single point on the grid and contain coordinates and data referencing each parcel of land. Ownership of land is represented by a ledger containing a smart contract. To obtain a LAND token, users must burn ERC20 MANA tokens. MANA tokens can be used to buy in-game items and services.

How Mana Works

Decentraland is an augmented reality that uses blockchain technology to track ownership of digital land. Users can use MANA tokens in a crypto wallet to participate in the NFT ecosystem and buy or sell land. Developers can create animations and interactions that users will encounter on their virtual real estate.

What is Mana Used For

Decentraland is primarily used as a game. However, it has many other potential applications, such as virtual business development. The video game was just the first application to be developed for Decentraland. MANA is mainly used as in-game currency, as it allows users to purchase and sell goods inside the game. However, MANA can also be used to buy and sell land within Decentraland.

Tezos XTZ

Tezos is a cryptocurrency that powers dapps on its decentralized platform. The transactions are known as ‘baking’ and the validators who state their tokens get rewarded in the XTZ, the native token for verifying newly-minted blocks. Tezos is designed to comply with an evolving digital world by facilitating formal verification, a technique that mathematically proves the correctness of the code governing transactions and boosts security considerably.

How Tezos Works

We may call it cryptocurrency, but Tezos has many features that set it apart from other tokens. While it is similar to other “altcoins,” Tezos’s blockchain splits into three protocols: a network protocol that discovers blocks and broadcasts transactions, a transaction protocol that specifies what makes a transaction valid, and a consensus protocol that forms consensus around a unique chain.

What is Tezos Used For

Instead of mining new blocks to keep the network operational, Tezos uses a “delegated proof of stake” (DPoS) consensus protocol, which reduces energy consumption, enhances speed, and increases transaction throughput. This DPoS protocol allows token holders to authorize transactions on the network. This system incentivizes users to become network delegates.

While other blockchains are trying to establish themselves as digital currencies or digital assets, Tezos focuses on its digital commonwealth — which is a shared set of rules and standards that govern the blockchain network. This lets developers create unique protocols for specific use cases, with support from Tezos itself. The blockchain can also be used as a governance tool from the support of its NFT token XTZ, to update the protocol democratically — this is what makes Tezos so powerful.

Sandbox Sand

Building on the Ethereum blockchain, The Sandbox lets you earn non-fungible tokens (NFTs) and develop a virtual character. With the ability to create NFTs by constructing your own avatar, playing games, and exploring different locations in the Sandbox Metaverse, this game is like an online version of Minecraft. Developed by Plug And Play — which is Silicon Valley’s oldest startup accelerator — The Sandbox has already won plaudits from both Crypto Briefing and Blockchain News.

Sandbox SAND is the native token of The Sandbox. It’s also the governance token of The Sandbox DAO, which governs every aspect of The Sandbox, from developed games to in-game transactions and lotteries.

How The Sandbox Works

The Sandbox is a gaming platform that uses blockchain technology to record the ownership of in-game assets and enable their transfer, sale, or use. The platform operates entirely on Ethereum, which records token ownership and enables owners to transfer, sell, or use them freely. IPFS is used to store all ASSETS-related information and assures that the information can’t change without the approval of the appropriate owners. The ERC20 standard is utilized for SAND, GEM, and CATALYST tokens, while the ERC1155 and ERC721 standards are used for LAND and ASSETS storage and trading.

The Sandbox is a unique virtual world where players can create their own NFTs (non-fungible tokens) using VoxEdit and Game Maker. These NFTs can be used to interact with other players or traded on the Sandbox Marketplace. Players can also monetize their NFTs by selling them for real-world currency.

What is The Sandbox Used For

The Sandbox gaming platform lets players create and customize their own games and digital assets using free design tools. The virtual goods they produce can then be sold as NFTs (non-fungible tokens) on The Sandbox Marketplace, using the Sandbox SAND token.

SAND is the key to all transactions and interactions within the game. Users can use SAND to participate in games and competitions, or purchase items from other players. SAND can also be traded on cryptocurrency exchanges.

SAND tokens can be staked inside the game to earn benefits like a share of transaction fees. Staking SAND also improves your odds of finding rare GEMs and CATALYSTs, which are used to make rare ASSETS.

Axie Infinity AXS

In Axie Infinity, every player becomes a part of the game economy and community. Whether you’re breeding axies, battling for territory, or strategizing for competitive tournaments, you’ll earn Axie points that you can use to help your Axies grow and evolve. The game’s tokenized ecosystem ensures full transparency and control for all its players — they can see how their actions affect the world around them.

Axie Infinity AXS is the native currency for the platform. Users can earn rewards by holding tokens, playing games, and participating in governance decisions with the governance token. Players can earn AXS by playing games on the platform and contributing to user-generated content initiatives.

How Axie Infinity Works

Axie Infinity is a game that rewards you for playing. By playing the game, you can earn Axies tokens — one of the most stable and valuable cryptocurrencies in the world. With Axies, players can breed their own creatures and sell them for other crypto or real-world money. Players can also use their hard-earned Axies tokens to get access to new parts of the game universe.

What is Axie Infinity Used For

Axie Infinity is a game played by both crypto-enthusiasts and gaming enthusiasts alike. By combining two of the most lucrative gaming niches, Axie Infinity will attract both crowds — as well as new players who want to learn about cryptocurrencies for the first time. Excellent gameplay will keep gamers coming back for more as they strive to obtain rare Axies/pets and battle their way up the game’s cosmic ladder.

By playing Axie Infinity, players have the potential to earn both AXS and SLP tokens. These tokens can then be exchanged for other cryptocurrencies, providing a way for players to generate money from the game. There are already many players taking advantage of this opportunity, and earning a profit as a result.

Theta

Streaming services are large, unwieldy, and expensive. Not only do your streams take forever to reach end-users, but you also have to split proceeds with middlemen — without even getting in on the action! Theta has a revolutionary blockchain architecture that can eliminate these problems. The decentralized network lets you stream direct-to-end-user faster, cheaper, and with fewer intermediaries — all while making sure that they can’t hijack your content.

Using Theta, content creators can distribute and monetize their videos directly to viewers — without relying on third parties like YouTube. In addition to this, the blockchain will make it possible for streamers to interact with their viewers in ways that have never been possible before, including allowing them to charge real-world money for virtual goods, or instantaneously tip people who are creating amazing content.

The network is powered by Theta tokens, which can be earned through video stream participation, used to pay for advertising fees, or sold on exchanges. Theta’s ultimate goal is to create a peer-to-peer (p2p) video streaming ecosystem – where viewers are rewarded directly as they contribute their resources.

What is Theta Network Used For

Theta is using blockchain technology to incentivize users to share their idle bandwidth — high-speed internet connections and video encode/decode hardware — with other users, giving everyone access to a decentralized network of online video delivery. Users who contribute bandwidth will be rewarded with the Theta token, which can then be used to improve your video viewing experience or to streamline the development of new applications on the platform.

Theta has a built-in payment system that allows creators and viewers to send and receive Theta Tokens (THETA) between one another. Creators can monetize their channels by rewarding content viewers for watching; viewers, on the other hand, can give back to content creators in a way that is economically feasible for both parties.

Where to Buy NFT Tokens

Most people buy and sell cryptocurrency on cryptocurrency exchanges. There are many reasons for this, but in its simplest and most decentralized form, cryptocurrency can be difficult to obtain and use. Additionally, because cryptocurrency markets are largely unregulated, prices are volatile, and scams and hacks are common, it is important to choose a reputable and stable platform you can trust.

Coinbase

Coinbase is a popular exchange that makes it easy to buy, sell, and exchange cryptocurrency. However, there are some things to be aware of before using Coinbase, such as fees and customer service issues. Overall, Coinbase is a secure way to invest and trade with cryptocurrencies.

Binance

Binance is the world’s largest crypto exchange. It has grown to become the biggest in just a few months, with an e-wallet and a decently intuitive interface. Its sheer size (its order book is massive) means that any coin you’re looking for should probably be there — and you’ll likely be able to find it at a great price.

Kraken

Kraken is an online cryptocurrency exchange that was established in 2011, making it one of the oldest exchanges in the world. It boasts support for over 120 cryptocurrencies, which can be bought and sold through the platform. The standard trading fee for all pairs is 0.16%, with discounts being given for high volume traders and for users who trade with the platform’s native currency (known as “Kraken”).

Gemini

Gemini is a user-friendly, fully regulated cryptocurrency exchange for serious and professional traders. With industry-leading security features, Gemini’s proprietary hot wallet, and a comprehensive customer service center, the exchange provides everything you need to trade cryptocurrency like a pro.

Crypto.com

Crypto.com offers a blockchain-based wallet that lets you manage all your digital assets with ease, so you can keep using them to support the world’s financial growth wherever and whenever you want. Whatever your digital currency needs are, it’s the perfect platform for managing and trading them — it allows flexible portfolio structure, automatic trade execution, and seamless coverage of over 20 altcoins.

bitFlyer

bitFlyer is perfect for retail traders looking to get involved with cryptocurrency trading, but it has some limitations for traders who want to do more than just buy and hold. For one thing, bitFlyer only supports Bitcoin markets, though there are plans to support Ethereum markets in the future.

How to Buy NFT Tokens?

If you plan to buy the best NFT tokens, using a recognized crypto exchange such as the ones previously discussed should be your priority. Below are general steps to buying NFT Tokens on any crypto exchange.

Step 1) First, open a cryptocurrency exchange account.

Step 2) The next step is to Register an account by tapping on the ‘Create Personal Account’ button.

Step 3) Fill in the required details and click on ‘Next’ to proceed

Step 4) The next step is account verification. To do this, you need to submit a copy of your driver’s license online and complete the face verification process.

Step 5) Deposit a minimum amount of $10 using either a bank wire transfer, debit card, or P2P.

Step 6) Once the deposit is confirmed, you can type in the ticker symbol for the NFT token and tap on the relevant pair you want to buy.

Step 7) Then, insert how much of the asset you purchase and tap on ‘Buy’ to complete the process.

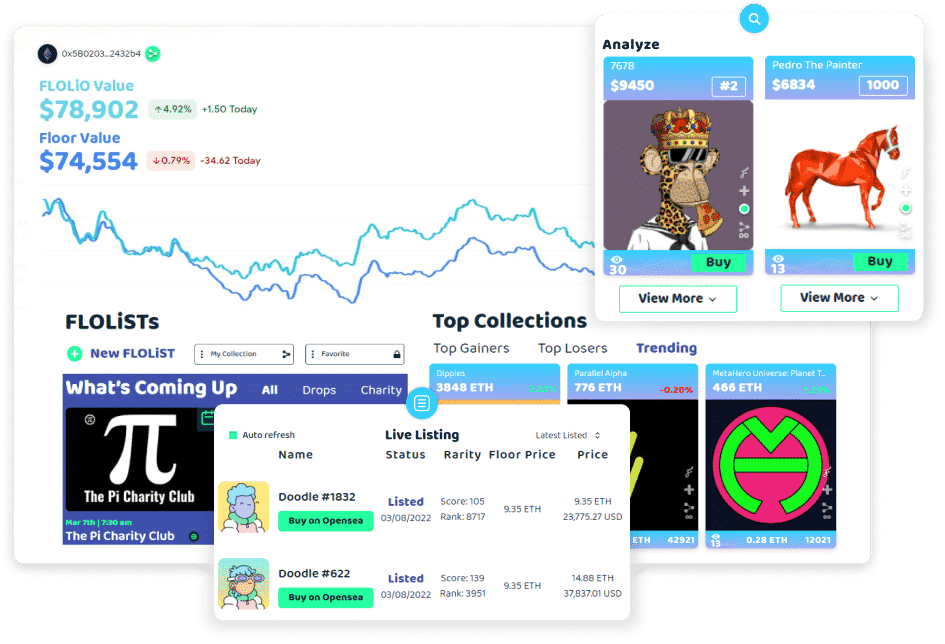

Wisdom within Web3

One place to manage all your digital assets

We combine data across marketplaces, metaverses, games & chains enabling communities to continue expanding the ecosystem.

In Conclusion

Crypto collectibles are crypto’s newest trend and one that is poised to continue into 2022. While some crypto collectibles have managed to garner massive value within the crypto community — up to a million dollars in some cases — there is always a danger behind investing in a niche market. While many investors would consider collectibles a risky investment, knowing your own risk tolerance is as important as knowing what you’re willing to invest in.