In 2013, Vitalik Buterin and his team of developers captured the attention of the media when they revealed their invention of a new blockchain that would rival that of Bitcoin. In July 2015, the first block on the blockchain, known as the “Genesis Block,” was laid – marking the official start of the Ethereum platform.

While the novelty and surging prices of Bitcoin and Ethereum generated widespread public interest, an American computer scientist was quietly working on his own distributed ledger that would be presented as an alternative to the blockchain.

The new technology, called a hashgraph, was described in its 2018 white paper as a project where carefully regulated nodes on the network “gossip” with each other about shared transactions, and which ultimately come to validate data through a consensus mechanism that eliminates the need for the blockchain’s proof-of-work (PoW) system.

Table of Contents

What is a Hashgraph?

While the hashgraph’s “gossip about gossip” system may sound confusing, the intention of its creator, American computer scientist Leemon Baird, was to simplify decentralized systems by improving the security and transaction times for users. Unlike blockchains, hashgraphs do not bundle data into blocks or use miners to validate transactions.

The hashgraph protocol utilizes network nodes that communicate between themselves about the details of each transaction. The data compiled from this “gossip” results in the creation of acyclic graphs that time-sequence transactions. Each message between nodes contains the timestamp, digital signature, and cryptographic hashes of two earlier events.

Shortly after his invention, Baird made use of his hashgraph algorithm to create Hedera, a company that he co-founded with his business partner Mance Harmon. Today, Baird is the co-founder and chief technical officer of Swirlds, a company that sits on the governing council of Hedera and holds the patents covering the hashgraph algorithm.

Hashgraph vs Blockchain

The Bitcoin blockchain employs a concept known as Proof-of-Work (PoW) which makes mining possible. On a general level, PoW is a decentralized consensus mechanism that requires members of a network to expend effort in solving a mathematical puzzle to prevent anybody from gaming the system.

Applied to Bitcoin mining, PoW is achieved when new blocks are created by miners, who are the individuals who own and use the computers required to solve complex mathematical equations. Approximately every ten minutes a miner generates a new winning proof-of-work, which is then accepted by the network – thus creating more Bitcoin.

The Hedera Hashgraph consensus algorithm does not require Proof-of-Work or similar systems, eliminating the need for high computational power and the vast amounts of electrical energy associated with those models.

Additionally, while Bitcoin miners can choose the order of transactions, delay them, or even stop them from entering the block, a hashgraph incorporates a consensus of timestamps which prevents individuals from changing the order of transactions.

Below is a chart detailing some other differences between a hashgraph and a blockchain:

Hashgraph

- Copyright – Patented

- Consensus Mechanism – Virtual Voting

- Security Mechanism – Asynchronous Byzantine Fault Tolerance (nodes agreeing with each other)

- Applications – Hedera Hashgraph

- Speed – 10,000 transactions per second

Blockchain

- Copyright – Open Source

- Consensus Mechanism – Proof-of-Work/proof-of-Stake

- Security Mechanism – Cryptographic Hashing

- Applications – Bitcoin and Ethereum

- Speed -7-10 transactions per second (Bitcoin); 15-20 transactions per second (Ethereum)

Hedera Hashgraph

A Dallas-based company, Hedera Hashgraph has the only authorized, public ledger in existence thanks to the hashgraph patents that the company owns. Its native cryptocurrency, HBAR, serves as the site’s digital token and powers the system.

Unlike a blockchain, where data is registered on a series of blocks, the distributed ledger technology behind Hedera’s platform can be thought of as a graph where the speed of verifying transactions rises as more transactions are added to the network. This technology is also known as a Directed Acyclic Graph (DAG).

The DAG mechanism results in remarkable transaction speeds, and Hedera network services can validate more than 100,000 transactions per second. Currently, Hedera performs 6.5 million transactions per day, with an average transaction time of five seconds – a figure that easily overshadows Ethereum’s 1.2 million and Bitcoin’s 300,000 transactions combined.

Approving Nodes

To achieve this amazing level of transaction speed, Hedera Hashgraph makes significant design trade-offs that differentiate it from other platforms. This entails only allowing pre-vetted, approved nodes to participate in the distributed ledger.

While many in the crypto community have criticized the company for its lack of a truly decentralized economy, restricting the number of nodes on the network means that transactions are finalized quickly. Additionally, limiting the number of nodes involved in key functions such as transaction ordering and time-stamping reduces the possibility of cyberattacks and gives businesses confidence when operating on the platform’s decentralized applications.

Governing Council

Although the Hedera Hashgraph platform regards itself as a public network on which anyone can transact and deploy decentralized applications, a select group of businesses oversees the software. This council of 39 multinational corporations, known as the Hedera Governing Council, is charged with running the consensus nodes that determine transaction ordering.

The council is composed of well-known companies such as Google, IBM, and Boeing, and its presence in the body gives companies a voice in managing the software, voting on changes, ensuring funds are properly allocated, and safeguarding the network’s legal status.

Companies that serve on the council do not remain there permanently. Each member can have up to two consecutive three-year maximum terms, after which they will be replaced by other interested parties.

Use Cases

Since its launch in 2019, Hedera Hashgraph has attracted several partners who are building on the site. Virtual trading platform TrakInvest, ad marketplace AdsDax, and farming loan platform Agryo have all started operating on the platform in recent months. AdsDax has gravitated toward the hashgraph model as the site’s marketplace is based on speed, while Agryo has used Hedera to build a decentralized data-driven prediction model.

Additionally, a cryptocurrency startup called Carbon has used Hedera to launch its first “stablecoin,” a digital token that maintains steady exchange rates with fiat money.

These companies value Hedera Hashgraph for many reasons, which include allowing transfers of value, creating and executing smart contracts, and initiating file transfers.

HBAR

The native cryptocurrency on the Hedera Hashgraph network, HBAR tokens allow users to transfer value and enable highly customizable transactions.

Currently, the HBAR cryptocurrency has a circulating supply of 20.74 billion and a 24-hour trading volume of $64.3 million. As of the writing of this article, the HBAR token price stands at $0.1502, which gives the digital asset a market cap of $3.1 billion.

Smart Contracts

Hedera Hashgraph can also be used to implement smart contracts. Like normal contracts, a smart contract establishes the terms of an agreement between parties. However, unlike paper contracts, smart contracts automatically execute when the terms are met without the need for either participating party to know who is on the other side of the deal — preserving the anonymity and safety of users.

File Service

Some companies have started to utilize the Hedera mainnet as a file service, where redundant, distributed files can be stored. This private network allows the user to organize their data structure in any way they choose, streamlining business operations and increasing efficiency.

Consensus Service

Lastly, Hedera Hashgraph can operate as a consensus service, where users can attain fast, secure, and fair consensus in any application that requires trust.

Real-World Example

One recent example of the power of Hedera’s product involved the rollout of Pfizer’s Covid-19 vaccine in 2021. Early in the year, it was revealed that the UK’s South Warwickshire NHS Foundation Trust had relied on Hedera Hashgraph and software company Everyware to track the temperatures of Pfizer’s vaccine throughout the transportation and storage process. Due to Internet-connected thermometers in the refrigerators, temperatures were instantly recorded in Hedera’s ledger.

Speaking on the initiative, Mance Harmon, one of the co-founders of Hedera, commented, “Everyware is monitoring the temperature of the vaccine, both in the data centers and at the hospitals. And that information flows through our system, and becomes tamper-proof information that people then can depend on in the future, to know exactly what the state of the vaccine was when it happened.”

The Future of Hedera Hashgraph

Although Hedera Hashgraph is still considered by many to be a slightly inferior network to the blockchain, the system is still in its infancy and many of its use cases have yet to be fully explored.

Recently, Hedera launched the Hedera Token Service, a feature that enables any user to create tokens on the platform. When the product is finalized, transferring tokens will cost just $0.001.

The network also plans to introduce scheduled transactions. When this is activated, a user will be able to specify a future time that they want a transaction to occur. Additionally, this feature can activate a transaction only when it’s first signed by several different people.

Disadvantages of Hedera

Despite the platform’s huge amount of potential, it’s only fair to mention the large number of critics that have pointed out flaws in Hedera’s operating model. One major criticism is that the technology has only been deployed in private and permission-based networks.

Additionally, unlike many cryptocurrencies, Hedera Hashgraph can only be accessed by certain individuals and thus isn’t considered open-source. This prevents developers from forking the protocol to create their public versions – similar to how Bitcoin was forked into Bitcoin Cash.

Swirlds, the company behind the platform, has stated that forks can cause splits among Hedera’s user base, which wouldn’t go down well with clients building on the platform. Whatever the company’s justification, no one can deny that Hedera Hashgraph offers a far more exclusive, centralized model than the blockchain – which markets itself as a path to decentralization and an escape from meddlesome third parties.

Although Hedera’s corporate council is reputable, it remains to be seen whether or not these companies will defend their interests when controversial issues arise or choose to look out for the community.

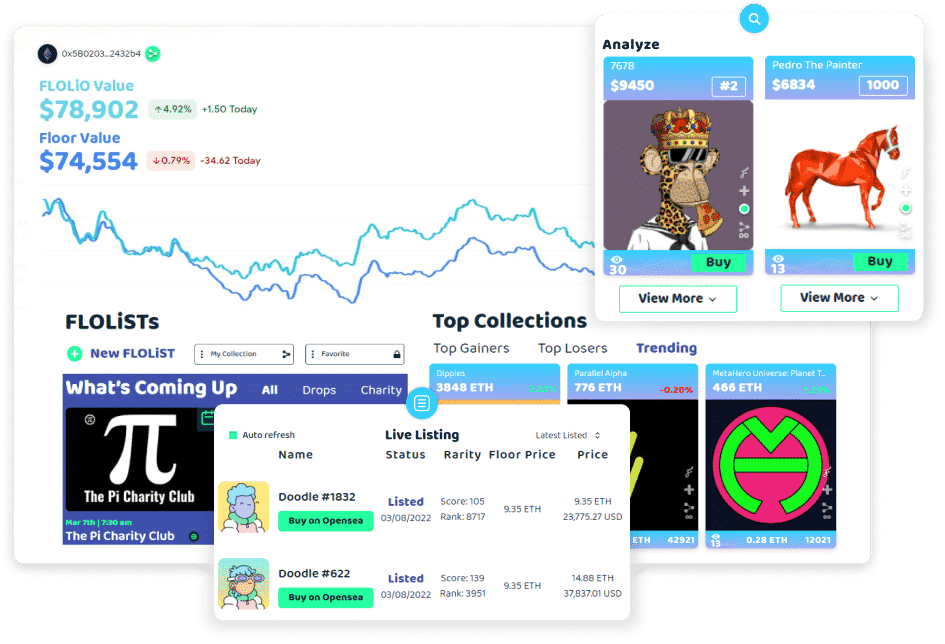

Wisdom within Web3

One place to manage all your digital assets

We combine data across marketplaces, metaverses, games & chains enabling communities to continue expanding the ecosystem.